Global wafer shortage and countermeasures

In recent years, the global supply and demand of wafers is unbalanced, and the shortage of 200mm wafers will continue for several years. The world's top five wafer producers - Japan's SEH, Sumco, Germany's Siltronic, Taiwan's GlobalWafter and South Korea's SK Siltron - have invested billions of dollars in new wafer equipment in the past year, and they account for 90 percent of the market, with the latest wafer plants not due to start production until 2024. Today, automotive radar, MEMS for home appliances, 5G mobile phones, etc., which use a large number of chips made of 200mm wafers, their output is small and manufacturing is complex. Wafer manufacturing, however, is not governed by Moore's Law.

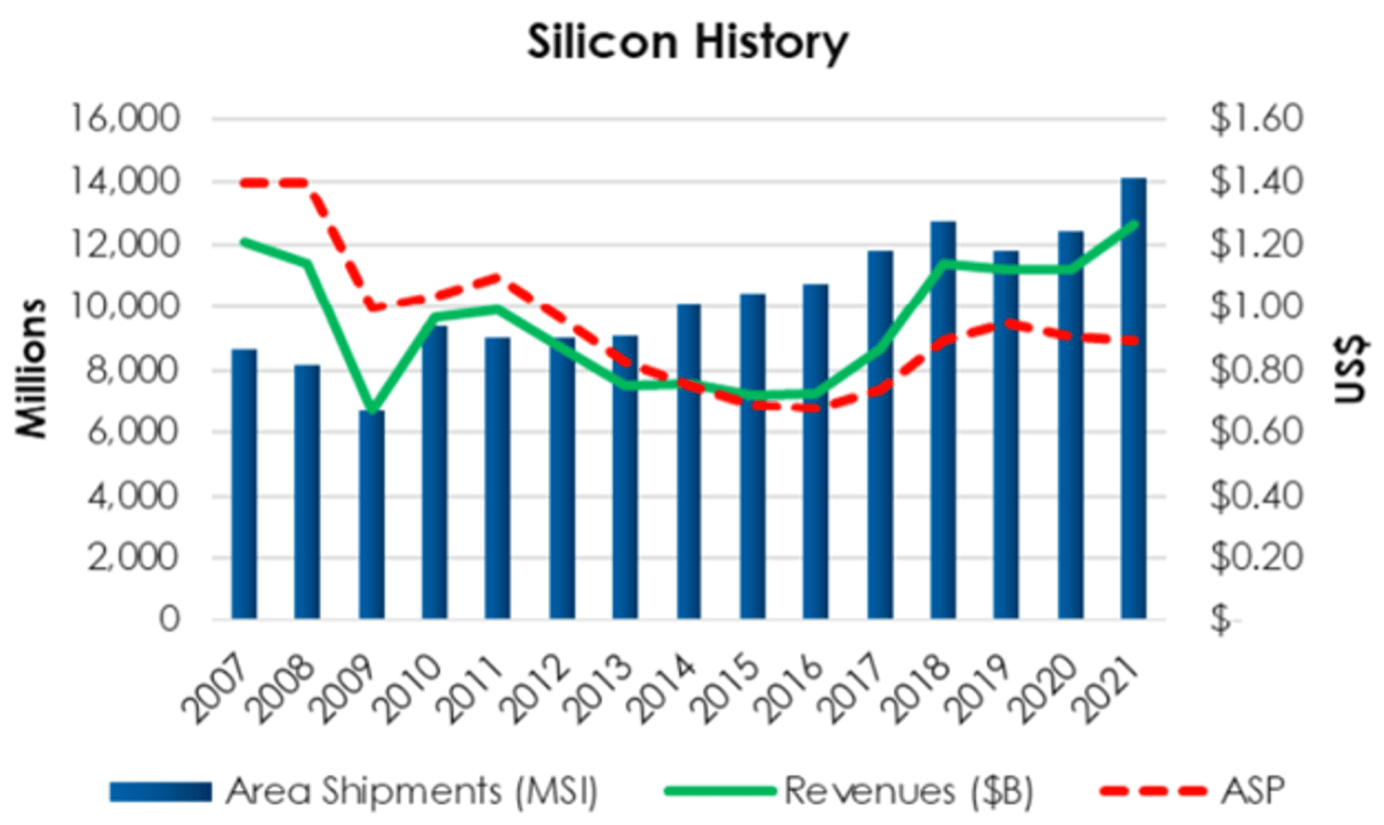

Due to the large demand for 300mm wafers at present, the relative capacity is tight, and the price of wafers has risen. According to Dan Tracy, director of market research at Techcet, wafer shipments grew 14% in 2021. Shipments of 300mm wafers exceeded 13% and shipments of 200mm wafers exceeded 15%. Total shipments are expected to grow by about 6% in 2022.

Revenue for the overall silicon market (including SOI wafers) grew 14.5% and will grow another 10% in 2022, peaking at $15.5 billion. This is the first time in more than 10 years that the wafer industry has achieved two consecutive years of double-digit growth. However, this increase was mainly due to higher wafer prices, rather than higher non-wafer production. Demand for 300mm wafers in 2022 will be about 7,200 wafers per month (wpm). But until 2024, even operating at 100 percent, the total production capacity of 300mm wafers will be about 10 percent less than demand. As a result, some customers have been allocated, especially second-tier vendors. At the same time, there is no shortage of silicon carbide (SiC) wafer-based chips in small scale and fast growth. But if demand goes as expected, a wafer shortage is coming for them, too. The two largest wafer suppliers, Japan's SEH and Sumco, together account for more than 50% of the market.

Activity to invest heavily in capacity for 300mm wafers is ongoing, but even so, demand will continue to outstrip supply and supply is likely to remain short in the coming years. 300mm wafer requirements are diverse. It's not just smartphones. It also includes data centers, automobiles, personal computers, artificial intelligence, industrial products, consumer goods, and more. Smartphones remain an important driver of 300mm wafers, but demand for more data center and automotive chips is growing as the industry shifts.

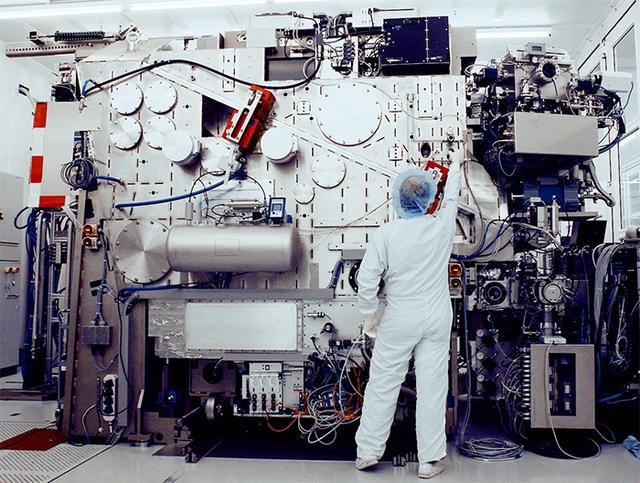

GlobalWafers, the world's third largest wafer supplier, had planned to acquire Siltronic. The deal was originally scheduled to close in January 2022, but was derailed after government approval failed. GlobalWafers said the approximately $5 billion they set aside for the Siltronic acquisition will be used for capacity expansion. At the same time, Siltronic is operating at full capacity and continues to press ahead with its €2 billion investment in its new 300mm fab "FabNext" in Singapore. Siltronic's Freiburg plant in Germany is building a new crystal production workshop, and South Korea's SK Siltron is also investing heavily in 300mm wafer manufacturing. In March 2022, the company announced an investment of approximately $1.2 billion to build a fab at the Fumei National 3d Industrial Park.

The 300mm wafer market is in short supply and may ease slightly in 2024. But 200mm wafers will continue to be in short supply. Ajit Manocha, President and CEO of SEMI, said: "Wafer manufacturers will add 25 new 200mm production lines over a five-year period to help meet the growing demand for applications such as 5G, automotive and Internet of Things (IoT) devices. These devices rely on devices such as analog, power management and display driver integrated circuits (ics), MOSFETs, microcontroller units (MCUS) and sensors." Although the Finnish wafer supplier Oketic has announced an expansion of 200mm wafer production capacity, it is still not enough to meet market needs. Oketic's customers use its wafers for chips in smartphones, portable devices, automotive electronics, industrial process control and medical applications, the Internet of Things, and various solutions to improve power usage and efficiency. SEMI reports that fabs will account for more than 50% of global 200mm fab capacity this year, analog fabs will account for 19%, and discrete/power fabs will account for 12%. On a regional basis, China will lead the world in 2022 with a 21 percent share of 200 million cubic meters of capacity, followed by Japan with 16 percent, Taiwan and Europe/Middle East with 15 percent each. As for the shortage of 200mm wafers, Samuel T. Wang, vice president of research, technology and service providers at Gartner, concluded, "There is no end in sight." "China may be the only solution."

At present, at least a dozen wafer suppliers in China have risen rapidly and are setting aggressive targets for their wafer suppliers. Although the quality needs to be improved, there are already vendors offering 200mm and 300mm wafers suitable for 90nm production. They include ESWIN, Hangzhou Semiconductor Wafer Co., LTD. (part of Nippon Steel Group), NSIG (National Silicon Industry Group), which is an investor in Soitec, oketic, ZingSemi and Simgui, The latter collaborates with Soitec to produce RF-SOI wafers, etc.), Chongqing Advanced Silicon Technology Co., LTD. (" AST ") and Nanjing Guosheng Electronics Co., LTD.

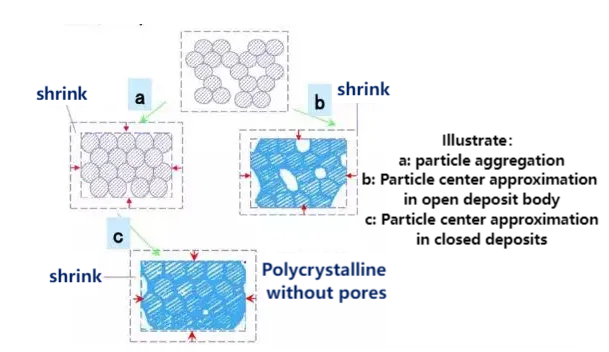

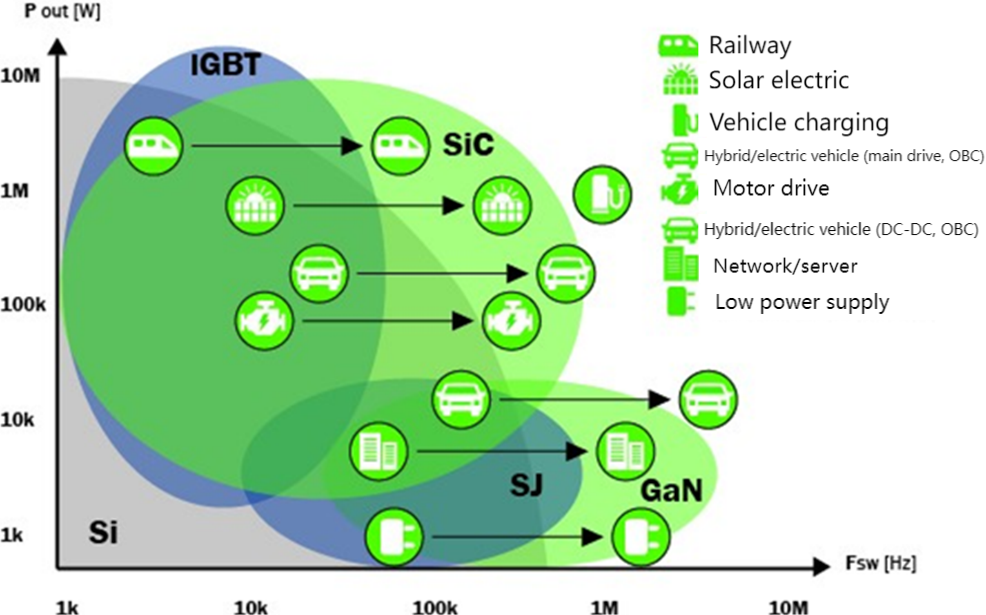

What China is really driving is the compound semiconductor business. Silicon carbide (SiC) wafers are used in the power application market, and there may be a certain shortage of supply at present. Silicon carbide wafers are much slower, more energy intensive and more expensive to manufacture than silicon wafers. SiC wafers (ingots) typically take weeks to grow in furnaces that are twice as hot as silicon wafers, produce only about 50 wafers per wafer, have yield losses in the 30% range, and cost 20-50 times more than silicon wafers. But because of the promise of SiC chips in solving electric vehicle range anxiety (and other power-related challenges), SiC is currently a source of growing competition. To that end, SiC leader Wolfspeed has just opened the world's largest silicon carbide plant in upstate New York and is expanding its materials plant in North Carolina. At the same time, SOI wafer manufacturer Soitec is actively developing Smart Cut technology to obtain 10 times more wafers from SiC wafers than are currently possible. The first production of their newest wafer plant is expected in the second half of 2023.

When there is a serious shortage across the chip industry, every sector can feel the shortage. Companies are stockpiling equipment, materials and even manufacturing equipment. Only after the chip industry has closed the loop of the entire ecosystem can serious and productive negotiations finally take place. All participants in the supply chain gain the visibility and trust they need to profit from each other. Otherwise, the industry risks falling into a deepening crisis.

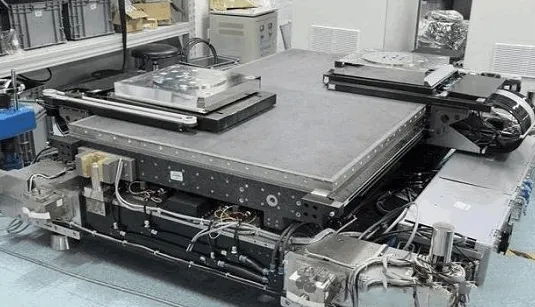

Fountyl Technologies PTE Ltd, is focusing on semiconductor manufacturing industry, main products include: Pin chuck, porous ceramic chuck, ceramic end effector, ceramic square beam, ceramic spindle, welcome to contact and negotiation!