Semiconductor equipment market cautiously optimistic, there are still bright spots

Recently, the world's top four semiconductor equipment manufacturers have successively announced the 2023 annual report or the latest quarterly report in 2024. Around the growth fulcrum of semiconductor equipment in 2024, technology priorities, and macro situation, the head companies have drawn these priorities.

High bandwidth memory becomes the growth momentum of semiconductor devices

"High-bandwidth memory will account for only 5% of DRAM production in 2023 and is expected to grow at a compound annual growth rate of 50% in the coming years. In fiscal 2024, we expect high-bandwidth memory packaging revenue to quadruple from last year to nearly $500 million." "Dickson said. ASML expects memory revenue growth in 2024, driven primarily by technology node conversion of DRAM driven by advanced memory products DDR5 and HBM. ASML's financial report for the fourth quarter of 2023 announced in January this year shows that the proportion of orders for memory chip systems has significantly increased. For the full year 2023, ASML's logic chip systems revenue was 16 billion euros, an increase of 60%. System revenue for memory chips was 6 billion euros, an increase of 9%, and there is a big gap with logic chip systems. However, in the net bookings in the fourth quarter of 2023, the logic chip system accounted for 53% of the bookings, and the memory chip system accounted for 47%, and the proportion of the two is balanced. Fanlin predicts that driven by the recovery of memory chips, the global fab equipment market will be about $80 billion in 2024. Among them, DRAM growth drivers mainly come from HBM capacity improvement and node conversion. According to the financial report, Fanlin's storage business achieved record revenue in the fourth quarter of 2023, accounting for 48% of revenue, of which DRAM revenue accounted for 31% and non-volatile storage was 17%. In TEL's fiscal 2024 third quarter earnings report released in February this year, it pointed out that the company's DRAM manufacturing equipment revenue has increased for three consecutive quarters, reaching 31% in this quarter, which is nearly double the proportion of the first quarter.

Advanced process-related equipment has stepped up the commercialization stage

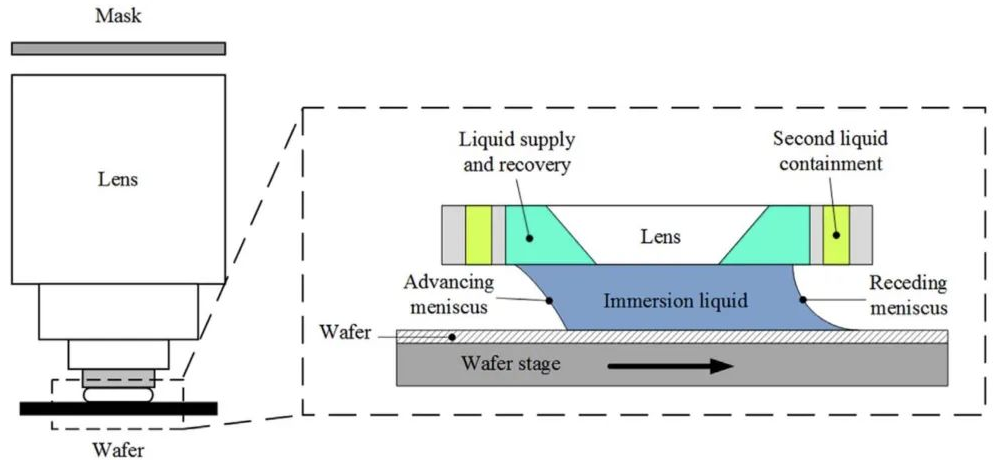

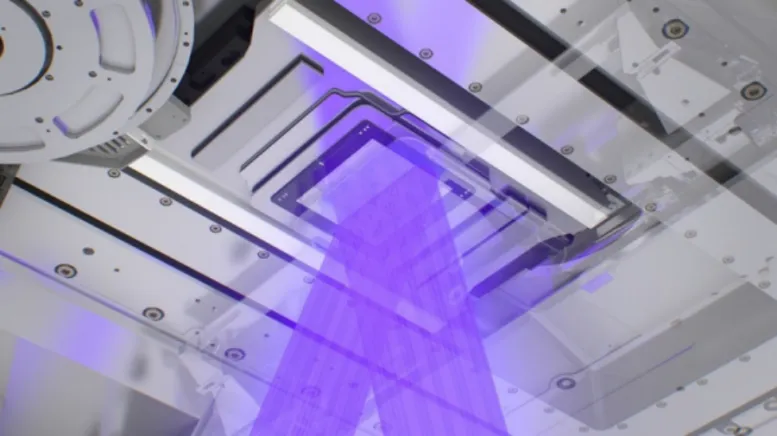

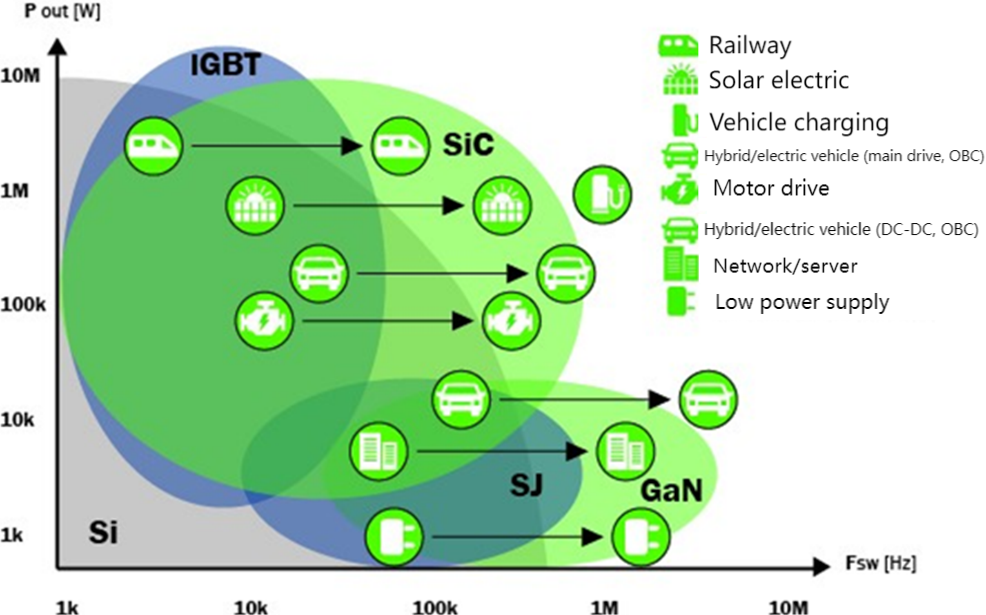

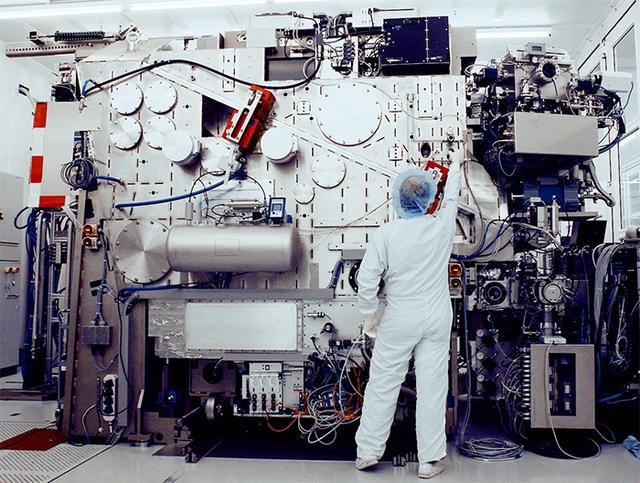

Cutting-edge logic chip foundry has always been the "big head" of semiconductor equipment manufacturers' revenue. In 2024, ASML will continue to introduce high numerical aperture EUV systems for cutting-edge processes, and Applied Materials and Pan Lin will also focus on advanced process-related requirements such as GAA transistors and backside power supply. High numerical aperture EUV lithography systems are regarded as the mainstream device path for processes below 2nm. In 2023, ASML sent Intel the first modules of its first high numerical aperture EUV system, the EXE:5000. By increasing the aperture value, ASML achieved a capacity of 185 wph (the number of wafers that can be processed in an hour) at an energy of 20mJ/cm2 (millijoules per square centimeter) in the EXE:5000 lithography system with a resolution of 8nm. Compared to the previous generation system, the feature size (the size of the smallest feature image that can be produced by the lithography process) can be reduced by 1.7 times and the transistor density can be increased by 2.9 times.

Roger Dassen, ASML's chief financial officer, said that ASML expects to incur significant costs in 2024 to introduce high numerical aperture equipment and increase its annual capacity to 90 EUVs and 600 DUVs. From 2025 onwards, ASML's EUV optical system will gradually transition to the higher margin, high numerical aperture system EXE:5200.

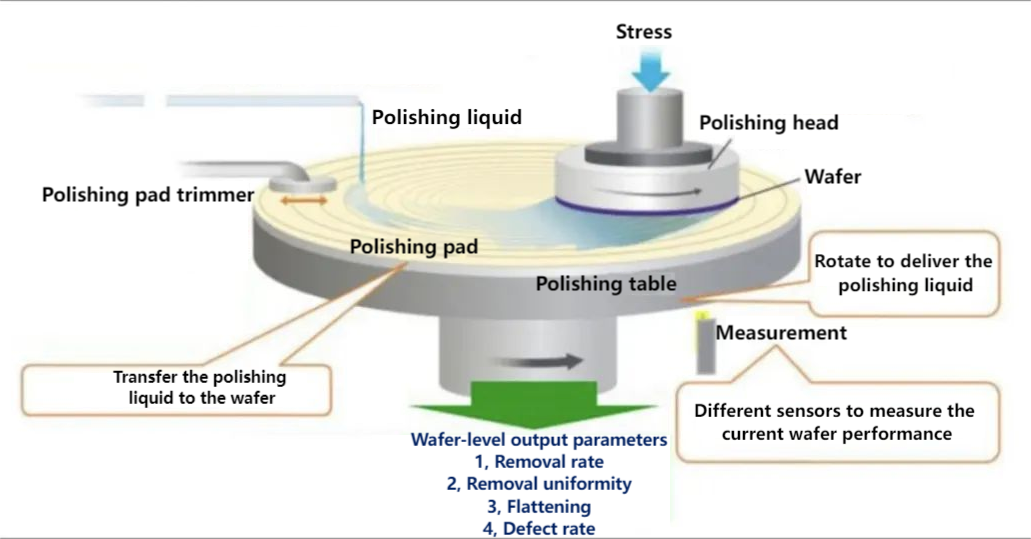

Applied Materials expects cutting-edge logic chips based on GAA transistors to move toward high volume production in fiscal year 2024. The shift in transistor structure from FinFET to GAA has expanded the profitability of Applied Materials, with the potential market for Applied Materials increasing by $1 billion every time the fab adds 100,000 wafers per month. Based on the demand for GAA transistor processes in fabs, Applied Materials introduced epitaxial growth devices for FINFETs and GAA transistors of 30nm and below, electron beam measurement systems that support 3nm logic chip foundry and graphical control capabilities required for GAA transistors. And selective etching tools to expand the application scope of FinFET and promote the future development of GAA. Backside power supply is seen by applied materials as another important technological turning point.

Equipment manufacturers are more optimistic about 2025 market expectations

Although the end market has shown signs of moderate recovery, and the DRAM market has picked up, equipment manufacturers' expectations for 2024 are conservative, and the market market in 2025 is generally optimistic. In 2023, ASML's full-year net income and net profit both increased by more than 30% compared to 2022, however, ASML's revenue forecast for the first quarter of 2024 is not optimistic, and net sales are expected to be between 5 billion and 5.5 billion euros. Compared with the net income of 7.237 billion euros in the third quarter of 2023, there will be a significant quarter-on-quarter decline.

ASML President and CEO Peter Wennink (hereinafter referred to as Wennink) is conservative about the market conditions in 2024, believing that the recovery situation in 2024 is still uncertain, and ASML's revenue in 2024 is expected to be similar to that in 2023. For 2025, Wennink has a positive view and sees 2024 as a transition period to prepare for significant growth in 2025. According to ASML, the market cycle curves of 2001 and 2009 are integrated, and the semiconductor industry tends to usher in a significant growth cycle after a downward cycle. Today's semiconductor industry is in the trough due to inflation, rising interest rates, economic slowdown and geopolitics, but manufacturers also need to prepare for the growth cycle after the trough. TEL is also optimistic about the performance of the fab equipment market in 2025. TEL comprehensive market research agency data believe that in 2025, the continued growth of AI servers, PC, smartphone demand driven by AI applications and replacement cycles, will jointly drive the capital expenditure of DRAM, NAND and advanced process logic chips, so that the annual fab equipment market size to achieve double-digit growth.

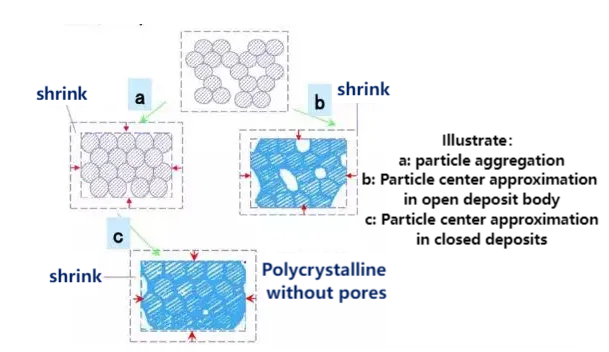

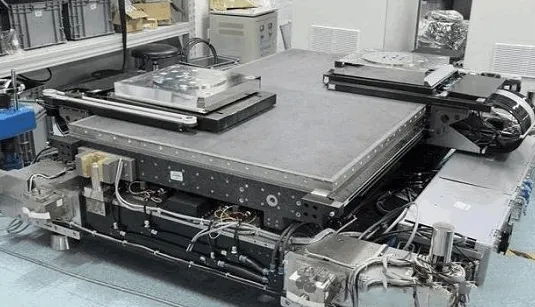

FOUNTYL TECHNOLOGIES PTE. LTD. was located in Singapore, we are focus on the research and development, manufacturing and technical services of precision ceramic parts in the semiconductor field for more than 10 years. our main product are ceramic chuck, ceramic end effector, ceramic plunger and ceramic square beam, including R&D department, QC department, Designing department and sales department.