The three major foundry giants launched the 2nm battle

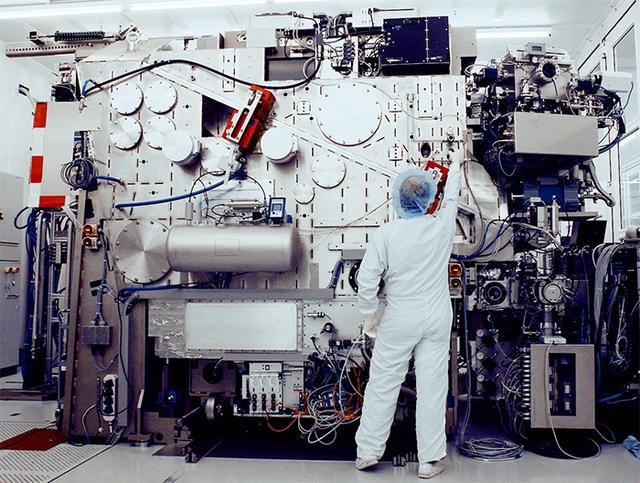

The world's leading semiconductor companies are racing to produce 2nm chips to power the next generation of smartphones, data centers and artificial intelligence (AI). Analysts still see TSMC maintaining its global dominance in the sector, but Samsung Electronics and Intel have seen the industry's next leap forward as an opportunity to close the gap.

For decades, chipmakers have been working to make more compact products. The smaller the transistors on the chip, the lower the power consumption and the faster the speed. Today, 2nm and 3nm are widely used to describe each new generation of chips, rather than the actual physical size of the semiconductor. Any company that takes a technological lead in the next generation of advanced semiconductors, an industry that accounted for well over $500 billion in global chip sales last year, will be in the driver's seat. This number is expected to grow further due to surging demand for data center chips that support generative AI services.

TSMC has demonstrated the N2 prototype process

TSMC, which dominates the global chip market, has shown process test results of its "N2" (2nm) prototype to some of its biggest customers such as Apple and Nvidia, according to two people familiar with the matter. TSMC has said the N2 chip will start mass production in 2025, typically launching a mobile version first, with Apple as its main customer. A PC version, as well as a high-performance computing (HPC) chip designed for higher power loads, will be available later. Apple's latest flagship smartphones, the iPhone 15 Pro and Pro Max, were launched in September and are the first mass-market consumer devices to feature TSMC's new 3nm chip technology. As chips get smaller, the challenge of transitioning from one generation or "node" process technology to the next is growing, raising the possibility of TSMC missteps that could cause its crown to slip. TSMC said its N2 technology development "is progressing well and is on track to reach mass production in 2025, and once launched, will be the industry's most advanced semiconductor technology in terms of density and energy efficiency." But Lucy Chen, vice president of Isaiah Research, noted that the cost of moving to the next node is rising, while performance improvements have leveled off. [Moving to the next generation] is no longer as attractive to customers."

Samsung wants 2nm to be a game changer

Two people close to Samsung said the South Korean chipmaker is offering a lower-priced version of its latest 2nm prototype to drum up interest from big-name customers, including Nvidia. "Samsung sees 2nm as a game changer," said James Lim, an analyst at U.S. hedge fund Dalton Investments. But doubts remain about whether it can execute the migration better than TSMC." Experts stressed that 2nm is still two years away from mass production, and the initial problems are a natural part of the chip production process.

Samsung has a 25 percent share of the global advanced foundry market, compared with TSMC's 66 percent, according to research firm TrendForce, and Samsung insiders see an opportunity to close the gap. Samsung was the first company to begin mass production of 3nm, or "SF3, "chips last year, and the first to switch to a new transistor architecture called GAA (surround gate).

According to two people familiar with the matter, Qualcomm is planning to use Samsung's "SF2" chip in its next high-end smartphone application processor (AP). After shifting most of its flagship mobile chips from Samsung's 4nm process to TSMC's equivalent process, Qualcomm's new choice would mark a shift in Samsung's fortunes.

Samsung said: "We are well positioned to achieve mass production of SF2 by 2025. Since we were the first to make the leap and transition to the GAA architecture, we expect the transition from SF3 to SF2 to be relatively smooth."

Analysts warn that while Samsung is the first to bring 3nm chips to market, it has struggled with yield issues, or the proportion of chips produced that are considered ready for delivery to customers.

Samsung insists its 3nm yield has improved. But according to two people close to Samsung, the yield of Samsung's simplest 3nm chips is only 60%, well below customer expectations, and the yield can drop further when making more complex chips like Apple's A17 Pro or Nvidia's graphics processing units (Gpus).

"Samsung is trying to make these giant leaps," said Dylan Patel, principal analyst at research firm SemiAnalysis. They can claim all they want, but they still haven't released a 3nm chip worthy of the name." Lee Jong-hwan, a professor of system semiconductor engineering at Sangmyung University in Seoul, added that Samsung's smartphone and chip design division is a fierce competitor to potential customers of logic chips produced by its contract manufacturing division, and that "Samsung's structure has caused many potential customers to worry about possible technology or design leaks."

Intel returns to contract manufacturing competition

Intel is also making bold claims that it will produce the next generation of chips by the end of 2024. That could put it back ahead of its Asian rivals, although doubts remain about the performance of its products.

At the same time, Intel is promoting its next-generation Intel 18A (equivalent to 1.8nm) process node at technology conferences and offering free test production to chip design companies. Intel has said it will begin production of the Intel 18A in late 2024, which could make it the first chipmaker to switch to the next-generation process.

But Wei Che-jia, TSMC's president, does not seem worried. He said in October that based on the company's internal evaluation, its latest 3nm (already on the market) is comparable to the Intel 18A in terms of power, performance and density.

Both Samsung and Intel hope to benefit from potential customers who reduce their dependence on TSMC, whether for business reasons or out of concern about potential geopolitical threats. In July, AMD CEO Zi-Fung Su said the company would "consider other manufacturing capabilities" in addition to those offered by TSMC as it pursues greater "flexibility."

Leslie Wu, CEO of consultancy RHCC, said major customers requiring 2nm-level technology are looking to spread chip production across multiple foundries and "relying solely on TSMC is too risky." But Mark Li, Bernstein's Asia semiconductor analyst, questioned "how much (geopolitical) factors matter compared to things like efficiency and schedule is debatable." TSMC still has advantages in terms of cost, efficiency and trust."

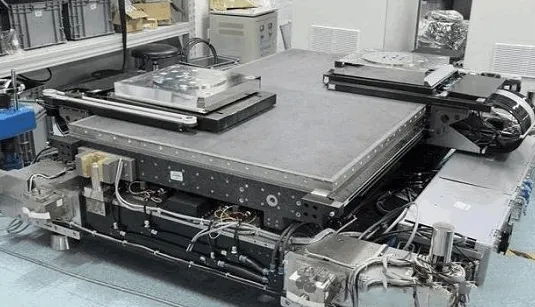

Fountyl Technologies PTE Ltd, is focusing on semiconductor manufacturing industry, main products include: Pin chuck, porous ceramic chuck, ceramic end effector, ceramic square beam, ceramic spindle, welcome to contact and negotiation!