Samsung divest ASML with profit by 8 times, why will the interest groups linked to EUV lithography machines be disintegrated?

According to South Korean media reports, Samsung Electronics disclosed an audit report showing that the company sold its remaining 1.58 million shares in Dutch semiconductor equipment maker ASML in the fourth quarter of last year. These shares are valued at about 1.2 trillion won (about 6.5 billion yuan), and it is understood that Samsung Electronics sold ASML shares to raise funds for its semiconductor process technology upgrade. In 2012, Samsung Electronics spent about 700 billion won to acquire about 3% of ASML shares for the development of lithography machine cooperation. In 2016, Samsung Electronics sold 1.3 percent of its shares in ASML and recovered about 600 billion won. Starting in the second quarter of last year, Samsung began to sell its remaining holdings, cashing out about 3 trillion won in the second quarter and reinvesting the funds in the semiconductor business; In the third quarter, about 1.3 trillion won was cashed out. The report said that it is estimated that Samsung Electronics' return on investment of 700 billion won reached about 8 times, and a large amount of cash flow injected impetus into Samsung Electronics' future research and development investment.

Will interest groups break up?

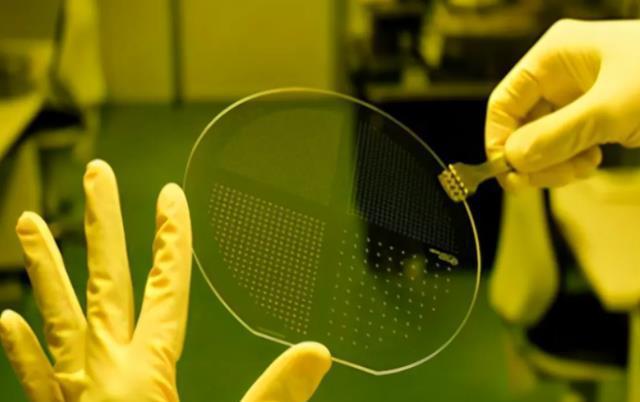

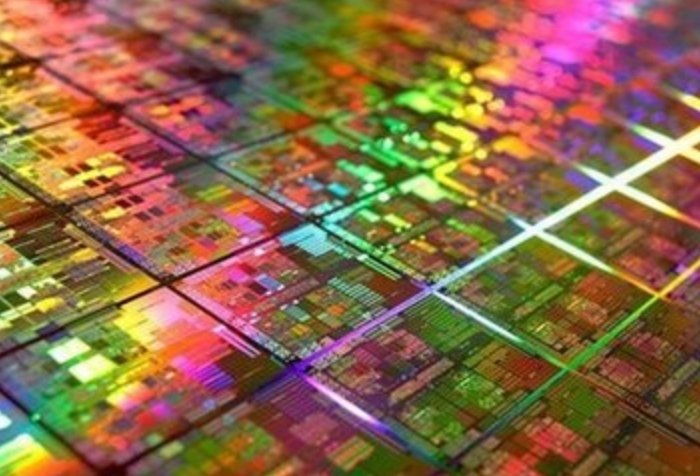

ASML dominates the global market share in exposure systems at about 95%. In its exposure system, the most expensive EUV sold well from the start.

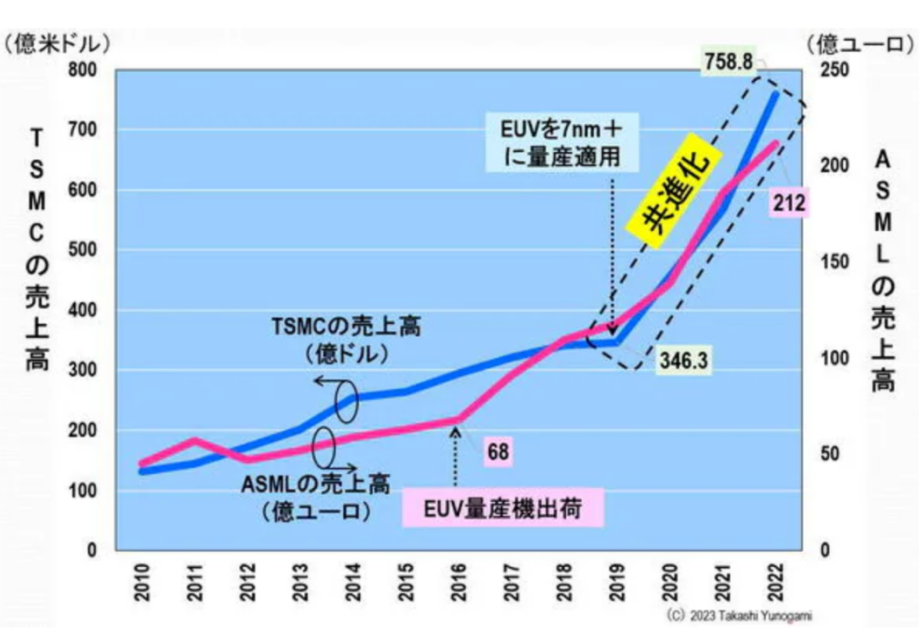

ASML's sales surge began in 2016, when it began mass production of EUV: from 6.8 billion euros in 2016, sales more than tripled to 21.2 billion euros six years later in 2022. On the other hand, TSMC's sales will increase rapidly from 2019 when EUV is applied to mass production above 7 nm; Sales increased 2.2 times from $34.63 billion in 2019 to $75.88 billion in 2022. Companies that also benefit from ASML's EUV lithography machines include Samsung and intel. With the support of EUV lithography machines, TSMC, Samsung and intel have established an absolute leading position in wafer manufacturing.

Limited capacity, the EUV lithography machine produced by ASML is also preferentially supplied to the three manufacturers of intel, TSMC and Samsung, and other manufacturers may obtain it only after the three manufacturers have bought it. Why would ASML preferentially sell to intel, TSMC, and Samsung? The first reason is that these three manufacturers are big customers and enjoy preferential treatment; the second reason is that these three manufacturers are shareholders of ASML, so of course, shareholders must be taken care of first.

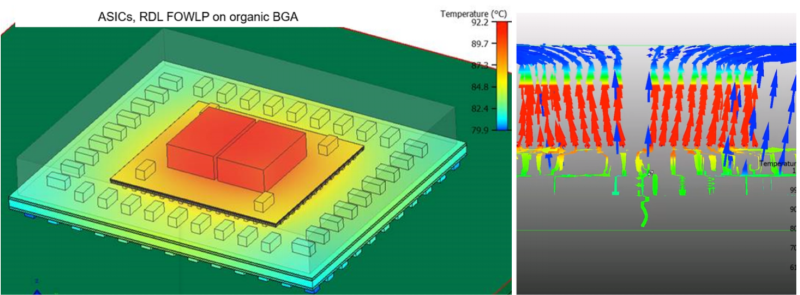

In fact, EUV lithography machine technology is a big project completed by intel, TSMC, Samsung assisted ASML, to a certain extent, these three companies are the main contributors to the successful development of EUV lithography machine technology. Developing the EUV lithography machine, ASML felt that the investment was too high and the risk was too great. Therefore, intel, Samsung and TSMC decided to invest money in ASML to support ASML's research and development of EUV lithography machines. At present, intel, Samsung, TSMC and ASML form a common interest group in the field of EUV lithography, and the four giant companies monopolize semiconductor wafer manufacturing.

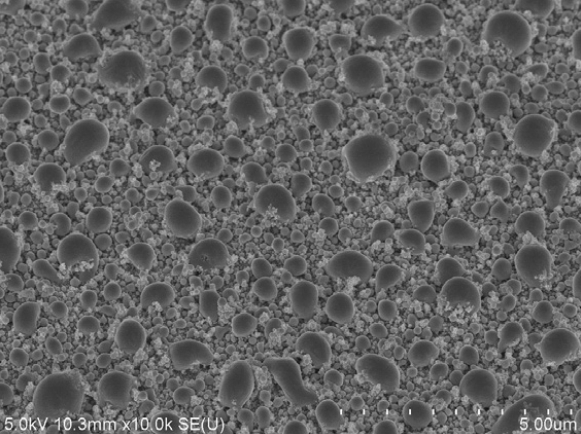

FOUNTYL Technologies PTE Ltd. produced ceramic chuck and ceramic arm are widely used in semiconductor manufacturing, mechanical processing, medical devices, chemical industry, environmental protection, energy, electronics, biochemistry and other fields due to their high temperature resistance, abrasion resistance, chemical corrosion resistance, high mechanical strength, easy regeneration and excellent thermal shock resistance.